Significant Salary Adjustment for Central Government Staff and Pensioners

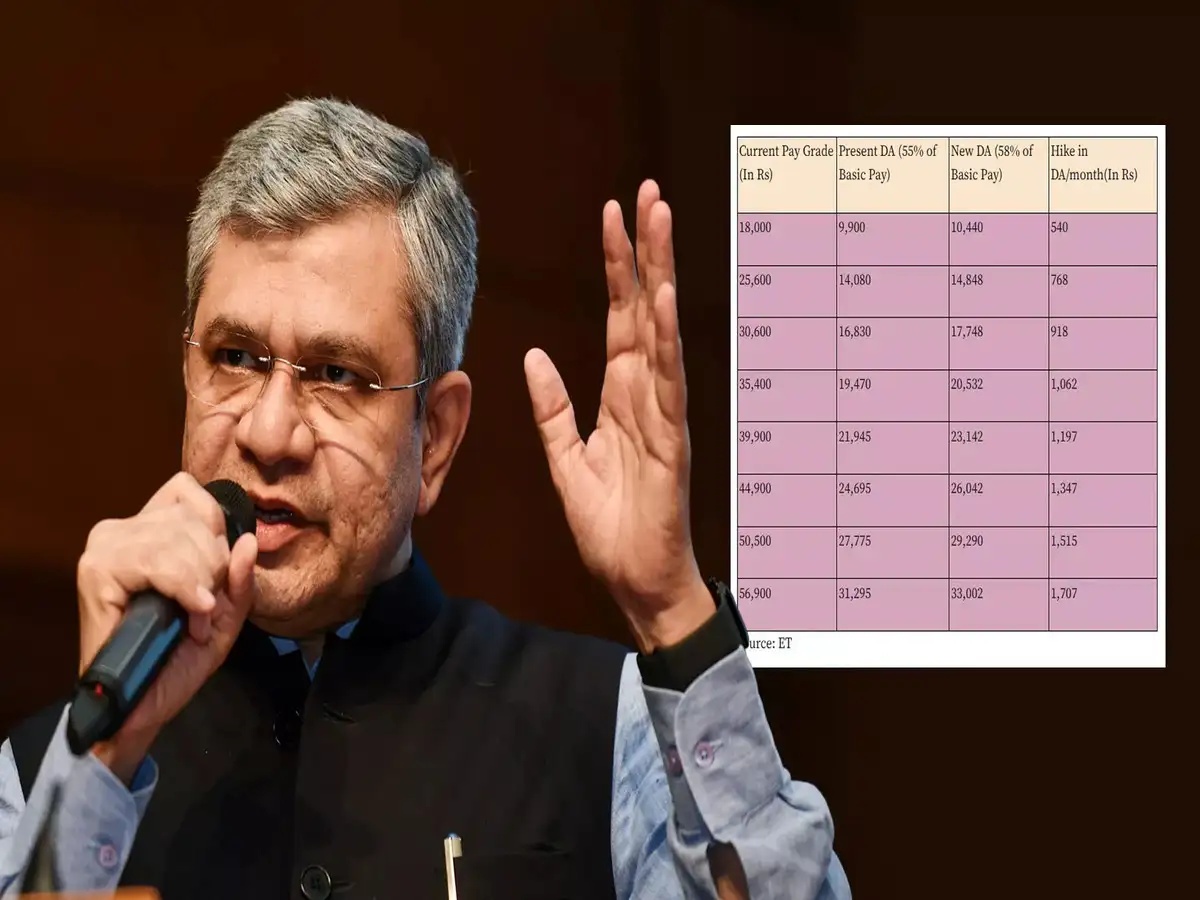

The Union Cabinet has finalized a major financial adjustment for central government employees and pensioners, approving a 3% increase in Dearness Allowance (DA) and Dearness Relief (DR). This decision, effective from July 1, 2025, will benefit approximately 49 lakh employees and 69 lakh pensioners across the country. The hike, calculated using the Consumer Price Index for Industrial Workers (CPI-IW) formula recommended by the 7th Central Pay Commission, aims to mitigate the impact of inflation on government salaries. The move follows a delayed announcement, which sparked concerns from labor unions about the timing of the revision. Despite the delay, the adjustment ensures that basic pay for employees earning a minimum of Rs 18,000 will increase by Rs 540, raising their monthly income to Rs 28,440. Pensioners receiving a minimum of Rs 9,000 will see their pensions boosted by Rs 270, totaling Rs 14,220. The financial implications of this decision are substantial, with the government allocating Rs 10,084 crore to implement the changes. This adjustment underscores the administration’s commitment to maintaining purchasing power for its workforce amid rising living costs.

Financial Impact and Cost-Benefit Analysis of the DA Hike

The 3% DA and DR revision is expected to incur a significant financial burden on the central government, with an estimated cost of Rs 10,084 crore over the next fiscal year. This allocation reflects the government’s prioritization of employee welfare, particularly in an economic environment characterized by inflationary pressures. The decision to base the hike on CPI-IW data ensures that the adjustment aligns with the current cost of living for industrial workers, a demographic often used as a benchmark for wage adjustments. While the increase is relatively modest, its impact on the livelihoods of millions of employees and pensioners is substantial. For instance, a minimum basic pay of Rs 18,000 will now translate to a monthly income of Rs 28,440, providing a buffer against rising prices. Similarly, pensioners will experience a tangible improvement in their financial stability, with pensions rising from Rs 9,000 to Rs 14,220. The government’s decision to delay the announcement until after Diwali, a major festival, has raised questions about the timing of such critical financial decisions. However, the revised schedule allows for better planning and resource allocation, ensuring smoother implementation of the hike.

Contextual Challenges and Union Concerns

The delayed announcement of the DA hike has drawn criticism from labor unions, particularly the Confederation of Central Government Employees and Workers, which highlighted the inconvenience caused to employees and pensioners. The Union Cabinet’s decision to postpone the release until after Diwali has sparked debates about the transparency and timeliness of government financial announcements. While the delay may have been strategic, it has raised concerns about the accessibility of crucial information for affected stakeholders. The 7th Central Pay Commission’s formula, which underpins the revision, ensures that the adjustment is both equitable and data-driven. However, the timing of the announcement has underscored the need for clearer communication channels between the government and its workforce. Despite these challenges, the hike represents a significant step toward addressing inflationary pressures on government salaries. The government’s commitment to maintaining the purchasing power of its employees is evident in the decision, which balances fiscal responsibility with the welfare of its workforce.

Broader Implications for Public Sector Stability

The 3% DA hike is not merely a financial adjustment but a strategic move to stabilize the public sector workforce in the face of inflationary challenges. By aligning the revision with CPI-IW data, the government ensures that the adjustment is both necessary and proportionate. This approach reflects a broader effort to maintain the financial health of the public sector while addressing the real-time needs of employees and pensioners. The allocation of Rs 10,084 crore for the hike underscores the government’s prioritization of employee welfare, even amid fiscal constraints. For employees earning a minimum of Rs 18,000, the increase provides a much-needed buffer against rising living costs, while pensioners benefit from a more secure financial future. The decision to delay the announcement, though controversial, highlights the complex interplay between fiscal planning and employee relations. Ultimately, the hike serves as a testament to the government’s commitment to balancing economic realities with the welfare of its public sector workforce.

Future Outlook and Policy Considerations

The 3% DA and DR revision marks a pivotal moment in the government’s approach to managing inflationary pressures on its workforce. By adhering to the 7th Central Pay Commission’s formula, the Union Cabinet has ensured that the adjustment is both equitable and data-driven. However, the delayed announcement has raised questions about the transparency and responsiveness of government decision-making processes. Moving forward, the government will need to address these concerns to maintain trust and ensure smooth implementation of future adjustments. The financial implications of the hike, while significant, demonstrate the government’s prioritization of employee welfare in an inflationary environment. For employees and pensioners, the increase offers a tangible improvement in their financial stability, providing a buffer against rising living costs. As the government continues to navigate economic challenges, the balance between fiscal responsibility and employee welfare will remain a critical consideration in shaping future policy decisions.